Ctc calculator 2021

Partial Expanded Child Tax Credit. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

Ctc Salary Calculator In Excel With Complete Payroll Setup Payroll Pedia

Have been a US.

. Additional fees terms and conditions apply. For Tax Year 2021 single taxpayers will be eligible for the full credit if their adjusted gross income AGI is at or below 75000 or 150000 for married filing jointly. If you are looking to automate you Organisations CTC salary structure in excel then you can download PayHRs Latest Excel CTC Salary Calculator in.

3000 for children ages. The Child Tax Credit can significantly reduce your tax bill if you meet all seven requirements. 2021 Child Tax Credit Calculator Estimate Your 2021 Child Tax Credit Advance Payments The IRS is no longer issuing these advance payments.

Consult your Cardholder Agreement for details. If your MAGI is 150000 or under you will receive 3600 per child under 6 and 3000 per child age 6-17. The credit will be fully.

An increase in penalty amount from. The reliability of the results depends on the accuracy of the information you enter. For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to.

Under the new provisions families are set to receive a 3000 annual benefit per child ages 6 to 17 and 3600 per child under 6 in the tax year 2021. Online CTC Calculator. It does not matter when during the year you.

This calculator is available for your convenience. Additionally the limit for the. Remember to clear your Internet.

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual. Claim the Child Tax Credit in 2022 by e-filing. Earlier provisions for penalties and imprisonment were 1 year and fine of Rs10000 with minimum imprisonment of 6 months and fine of Rs5000.

If your MAGI is over 75000 the. For a full schedule of Emerald Card fees see your Cardholder. If your child died on or after January 1 2021 you remain eligible to claim the 2021 Child Tax Credit for the full year and no action is required.

3600 for children ages 5 and under at the end of 2021. Disbursement of advance Child Tax Credit payments began in July and continued on a monthly basis through December 2021 generally based on the information contained in. 2021 HRB Tax Group Inc.

Take Home Salary Calculator India Excel 2021 22 Moneyjigyasu

Take Home Salary Calculator India 2021 22 Excel Download

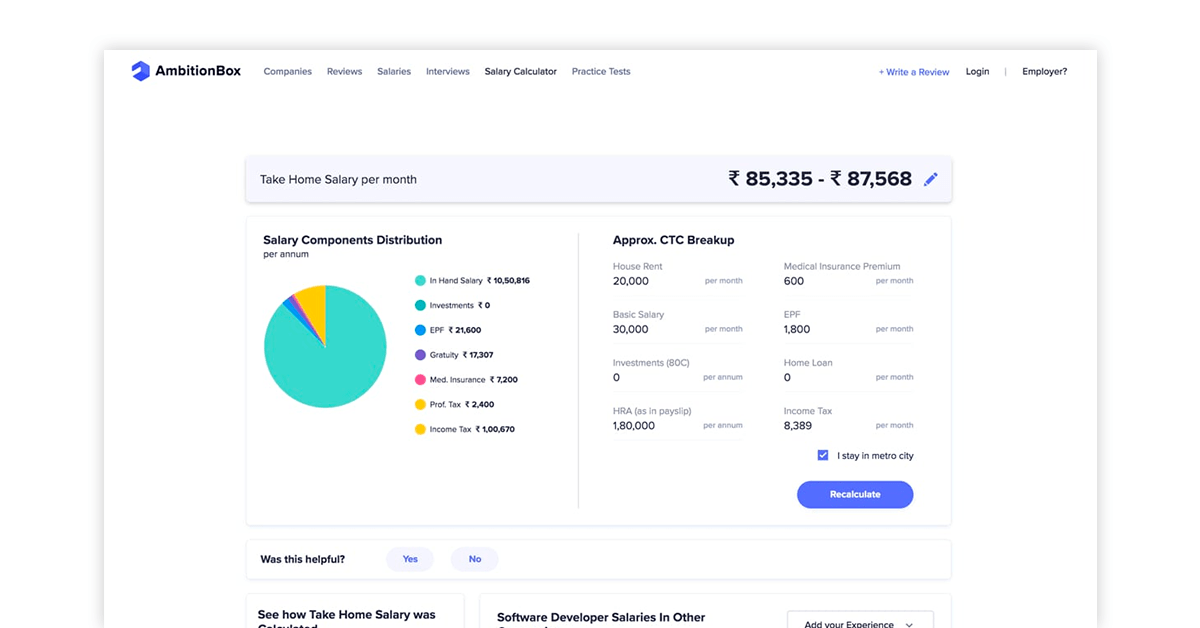

Ctc Calculator What Is Ctc And How To Calculate Take Home Salary From Ctc

Salary Ctc Calculator Quikchex

Salary Breakup Calculator Excel 2022 Salary Structure Calculator

10 Best Free Payroll Calculator In India Fy 2021 22 Paycheck Calculator

Ctc Calculator What Is Ctc And How To Calculate Take Home Salary From Ctc

How To Calculate Salary Structure For Freshers Career Guidance

Excel Ctc Calculator For Hr Professionals Payhr

How To Calculate My Monthly Salary In India If I Know My Ctc And The Split Ups Quora

Ready To Use Child Tax Credit Calculator 2021 Msofficegeek

Income Tax Calculator India In Excel Fy 2021 22 Ay 2022 23 Apnaplan Com Personal Finance Investment Ideas

Salary Breakup Calculator Excel Pdf

Take Home Salary Calculator India 2021 22 Excel Download

Salary Breakup Calculator Excel 2022 Salary Structure Calculator

Rajesh R Rajesh600054 Profile Pinterest

Understand Salary Breakup In India Importance Structure And Calculation Asanify